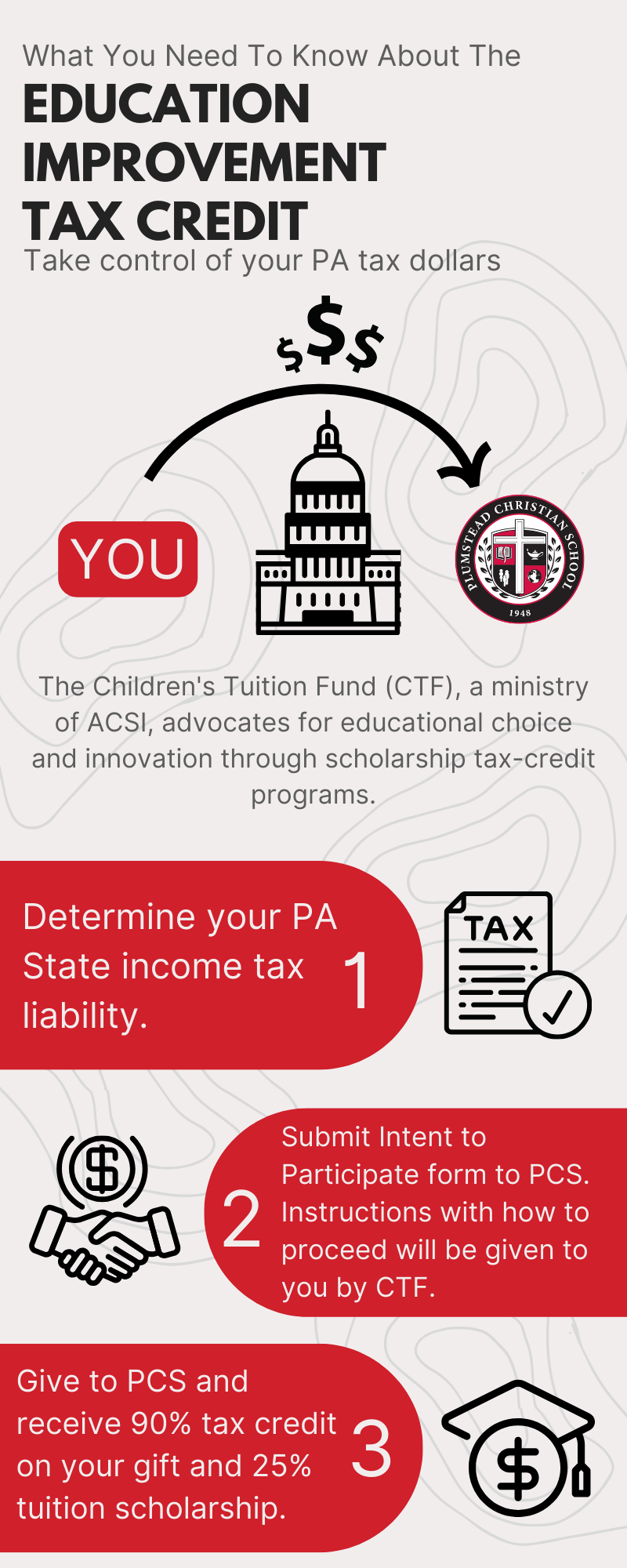

Education Improvement Tax Credit (EITC)

The Children's Tuition Fund has extended to Plumstead Christian School the ability to raise $300,000 for the EITC program.

For our current PA families, participation in the EITC program comes with an additional incentive - the school will credit each family with a tuition credit toward their own child's tuition equal to 25% of their total EITC contribution (not to exceed the total amount of tuition for the year).

Even if you are already giving to the EITC program this fall may be an opportunity for you to increase the amount of giving that you can do through EITC.

An Example of EITC:

A $10,000 EITC contribution blesses the school with $9,500 toward tuition assistance. The Children's Tuition Fund uses 5% toward management/service fees. The participant receives 90% of this money ($9,000) back to them as a tax credit against their state income taxes. The additional $1,000 that is "out of pocket" can be claimed as a federal charitable tax gift, and the school will provide a tuition credit against your child's tuition of $2,500.